Backing Founders Beyond the Bubble

We invest in resilient, data-driven founders building AI, health, and workforce infrastructure in overlooked markets.

Partner With UsOur Plan

We back resilient, data-driven founders building AI, health, and workforce infrastructure beyond the coastal capital bubble.

$50M fund targeting ~20 Seed & Series A investments in underserved U.S. markets

Focused on companies led by underrepresented founders outside traditional tech hubs

Initial checks of $500K - $2M with targeted 8-15% ownership

We expect to lead or co-lead ~1/3 of investments, with pro-rata participation in follow-ons

Backing founders building in AI, digital health, and workforce infrastructure

Focused on data-rich, software-enabled models solving complex operational or access challenges

Built on Fund Zero: 50 companies, $162M revenue, $107M follow-on capital raised

Demonstrated traction sourcing and scaling companies in overlooked markets

Together, these pillars define a repeatable model for backing underrepresented founders and transforming overlooked markets into high-performing portfolios.

Thesis / Where We Play

We invest in early-stage AI, healthcare, and workforce companies in markets where capital is scarce but talent is not.

What we do:

Back early-stage founders building in AI, digital health, and workforce infrastructure

Where:

We prioritize markets outside of traditional venture capital centers, while remaining open to compelling opportunities in all geographies

Why it works:

Our sourcing model delivers early access, advantaged entry valuations, and deeper founder alignment where mainstream capital underestimates value

This is where others underprice risk – and where we consistently unlock venture-scale opportunity.

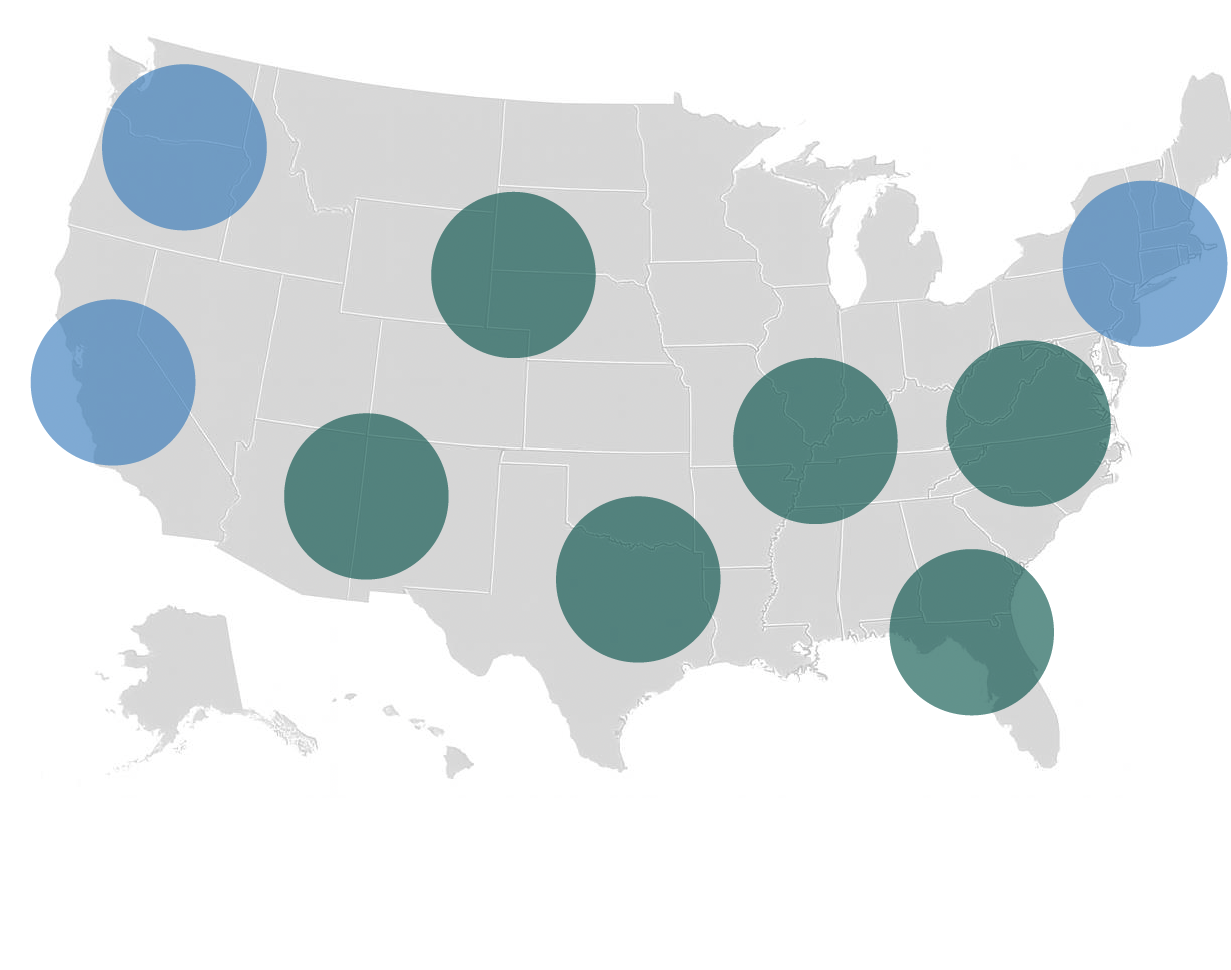

Why Now: Overlooked Markets, Unlocked Value

While VC crowds into the coasts, job growth and real value are accelerating in overlooked markets – where lower competition, stronger founder ties, and better entry valuations compound our sourcing edge.

Where Traditional Venture Capital Has Funded:

- 70%+ of U.S. VC is concentrated in the Bay Area, New York and Boston

- Valuations are often inflated, competition is fierce

Where We Play

- Markets outside of traditional VC centers - <15% of VC AUM, but:

- → Regions represent ~70% of US job growth

- → 60%+ of STEM grads

- Valuations are lower, with stronger founder alignment and faster diligence

Metallum's Edge: We don't follow capital – we follow momentum, talent, and mispriced opportunity.

Source: NVCA & Pitchbook.

Metallum Sourcing Engine & Edge

We scale pipeline intelligently – combining always-on sourcing with rigorous screening and trusted founder networks to surface the most compelling early-stage companies.

Always-on Sourcing Flow

Metallum sources roughly 1,000 new opportunities per year via proprietary deal networks, platform partners, and warm inbounds. Investment team tracks and qualifies deals weekly, building real-time pipeline visibility.

Institutional Screening Process

Each deal undergoes structured, multi-step evaluation – combining quantitative benchmarking with deep founder engagement. The team emphasizes character, mission alignment, and asymmetric upside.

Edge via Bronze Valley + Partner Ecosystems

As an affiliate of Bronze Valley (an early-stage VC firm), Metallum leverages trusted founder communities and inclusive capital platforms.

Together, these systems power Metallum's sourcing advantage – enabling repeatable, high-conviction selection in overlooked markets with asymmetric upside.

Why Founders Choose Metallum

We invest early, show up often, and provide founders with strategic firepower, operator insight, and aligned, transparent capital.

We show up early and often – as the first check, the first call, and the last one standing. Founders trust us because we move with conviction and deliver when it matters most

As former founders, executives, and ecosystem builders, we provide access to capital, customers, and co-investors – with practical guidance informed by experience.

We build long-term relationships grounded in trust and clarity – offering straightforward feedback, aligned incentives, and durable support from seed to scale.

Together, these pillars shape a founder-first model – building trust, unlocking scale, and transforming overlooked innovators into outperforming companies.

Representative Track Record

Proven results from overlooked markets: We've backed founders outside the spotlight – and delivered top-tier returns with unmatched efficiency.

| Company | Sector | Initial Investment Date | Invested Amount | Appreciated Value | Total Value | Gross IRR | Multiple of Cost |

|---|---|---|---|---|---|---|---|

| ACCENCIO | Data Analytics | 12/15/2023 | $100,000 | $100,000 | $200,000 | 100.00% | 2.00x |

| ACCLINATE | Healthcare | 2/26/2021 | $400,000 | $1,242,857 | $1,642,857 | 93.67% | 4.10x |

| Brevity | B2B SaaS | 2/3/2022 | $200,000 | $96,078 | $296,078 | 13.40% | 1.48x |

| EmployeeGPS | HRTech | 4/5/2019 | $150,000 | $41,800 | $191,800 | 4.10% | 1.30x |

| Freeing Returns | eCommerce | 7/30/2021 | $200,000 | $225,000 | $425,000 | 22.82% | 2.10x |

| wildwonder | Consumer | 8/6/2021 | $250,000 | $75,000 | $325,000 | 8.05% | 1.30x |

We invest with intention in high-growth markets – and deliver consistent, compelling outcomes through disciplined sourcing and alignment.

Where Capital is Scarce but Talent is Not

We invest in markets where others underprice risk – and where we consistently unlock venture-scale opportunity.

Where We Invest

We back founders building in three high-growth sectors with data-rich, software-enabled models.

Artificial Intelligence

GenAI applications solving complex operational challenges across industries, from sales enablement to healthcare engagement.

Digital Health

Healthcare technology addressing access, engagement, and clinical trial diversity through community-driven platforms.

Workforce Infrastructure

Tools and platforms transforming how people work, train, and build financial wellness in the modern economy.

Our Mission

We're more than investors – we're on a mission to back underrepresented founders in overlooked markets and deliver venture-scale returns.

Intentional Capital

We deploy capital where it creates the most impact and opportunity.

Data-Driven Approach

Our investment decisions are backed by rigorous analysis and market insight.

Founder Partnership

We're committed partners, bringing operational expertise and networks.

Our Team

Former founders, operators, and investors with deep expertise in building and scaling companies.

Neill S. Wright

30+ years as investor, entrepreneur, banker and operator. Founded Bronze Valley and led turnaround as Chairman & CEO of regional bank.

Robert L. Crutchfield

40+ years as investor, operator, and healthcare executive. Led early-stage investments with $1.2B+ in exit value at Harbert Growth Partners.

Anthony Abney

10+ years of investment and venture capital experience. Fintech founder and launched VC investing platform at the Enterprise Center.

Let's Build Together

Are you a founder building in AI, digital health, or workforce infrastructure? We'd love to hear from you.

Get in Touch